Our breakdown of what’s changing and how.

In 2014, Facebook paid £19 billion to buy WhatsApp. Today, nearly ten years on, there are still no ads on the chat app. Instead Facebook (now Meta) is trying to monetise its acquisition by selling WhatsApp’s reach to enterprises.

Yes, this is the WhatsApp Business (WAB) App, which is free to use for micro and small firms, but comes with monthly messaging costs for medium and large enterprises. Basically, companies can use the app to communicate with their customers. And given that WhatsApp has around 2.5 billion users, it’s a good bet they will succeed. Although it is worth noting that despite its reach, WhatsApp will still have to compete with existing services that can access all mobile users today – mainly SMS.

Market analyst Mobilesquared has predicted big things for WhatsApp Business. It said the service generated spend of $38.7 million in 2019 will grow to $3.6 billion by 2024.

In order to keep the right balance between enterprise buy-in and revenue, WhatsApp regularly tweaks its pricing. Generally, it charges more for marketing than it does for more functional comms – a deliberate strategy to reduce the incentive to send spam. WhatsApp also varies its fees by region. This provides an opportunity for enterprises and platform providers but a threat to messaging service providers, as it will compete directly with their service.

At GTC, we follow these changes carefully. We posted our first price analysis a few months ago. But now, with new fees introduced on June 1st, we are ready with a second post. Please see the below infographic for more information.

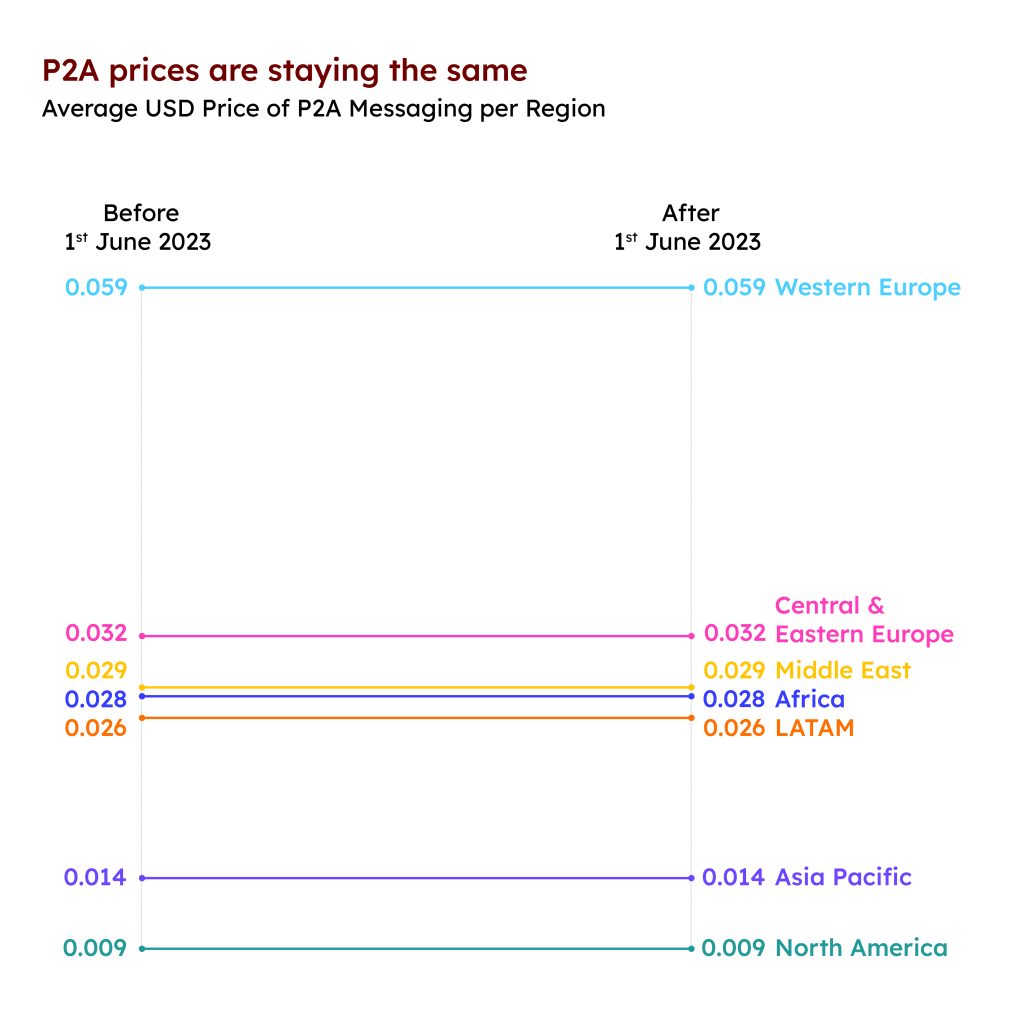

1. P2A prices are staying the same for now

P2A prices did not change on June 1st. So the existing regional differences will persist. As such, Western Europe remains far more expensive than other territories.

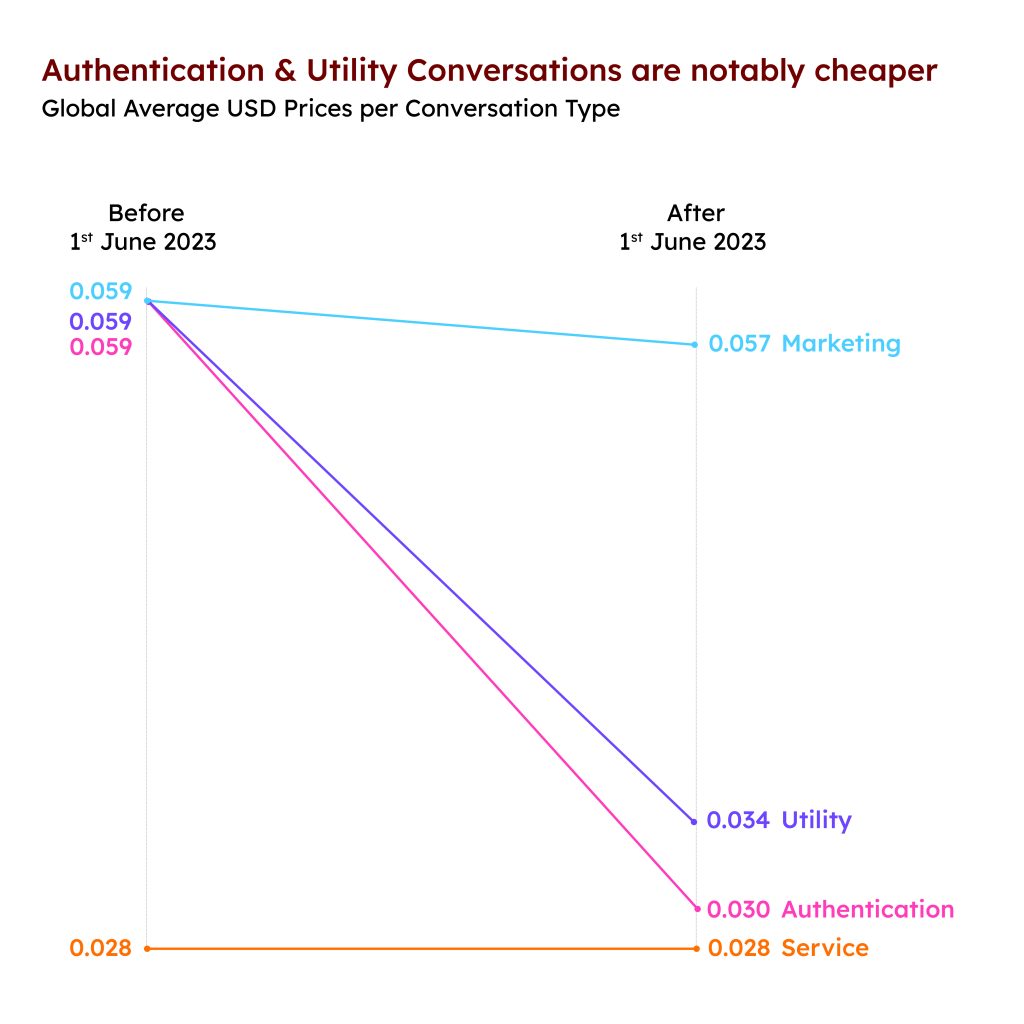

2. A2P utility messages are getting cheaper (relatively)*

*considering global averages

WAB messages for utility, authentication and service purposes have been going down, which suggests that WhatsApp wants to challenge other messaging types that customers trust and value. However, fees for marketing traffic have barely changed overall (though there have been local changes – see point 3). This possibly reflects WhatsApp’s desire to limit spam on its channel.

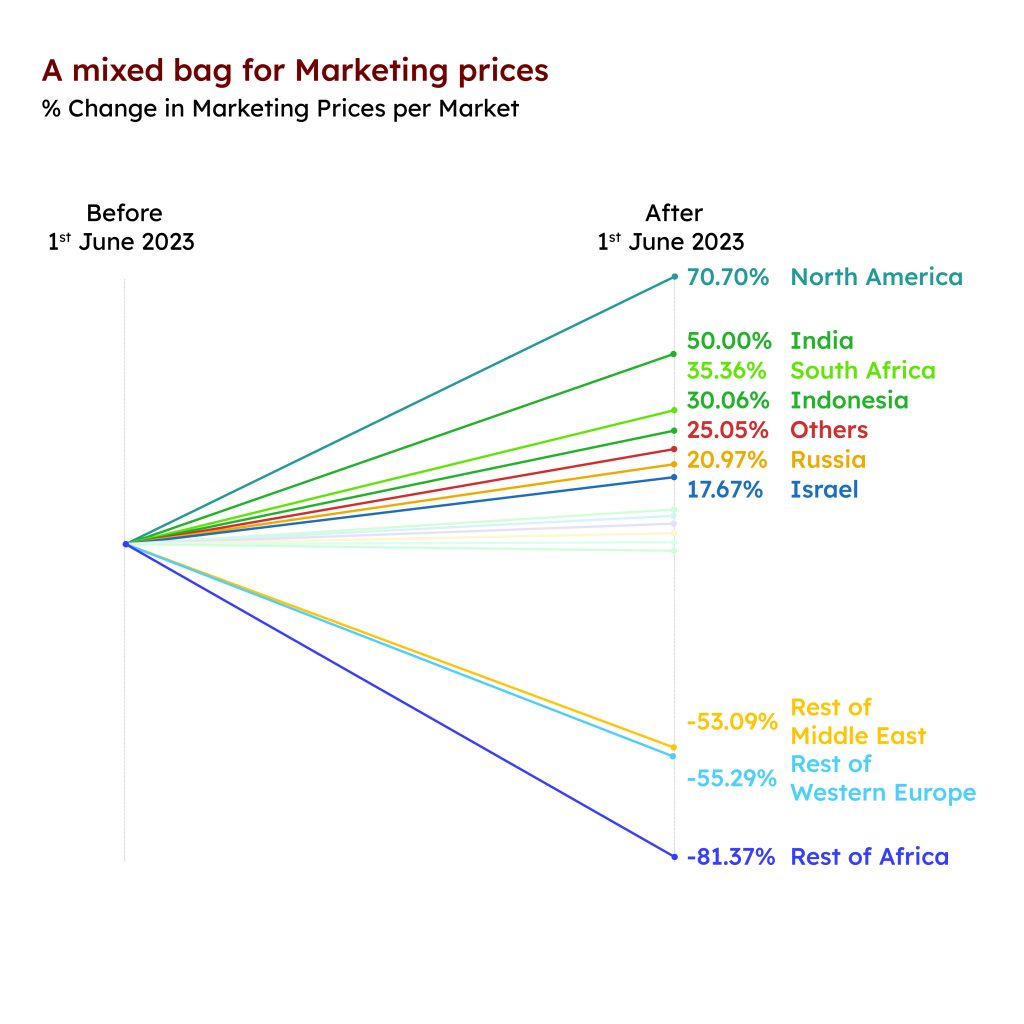

3. WAB is reducing marketing fees in some regions to drive usage

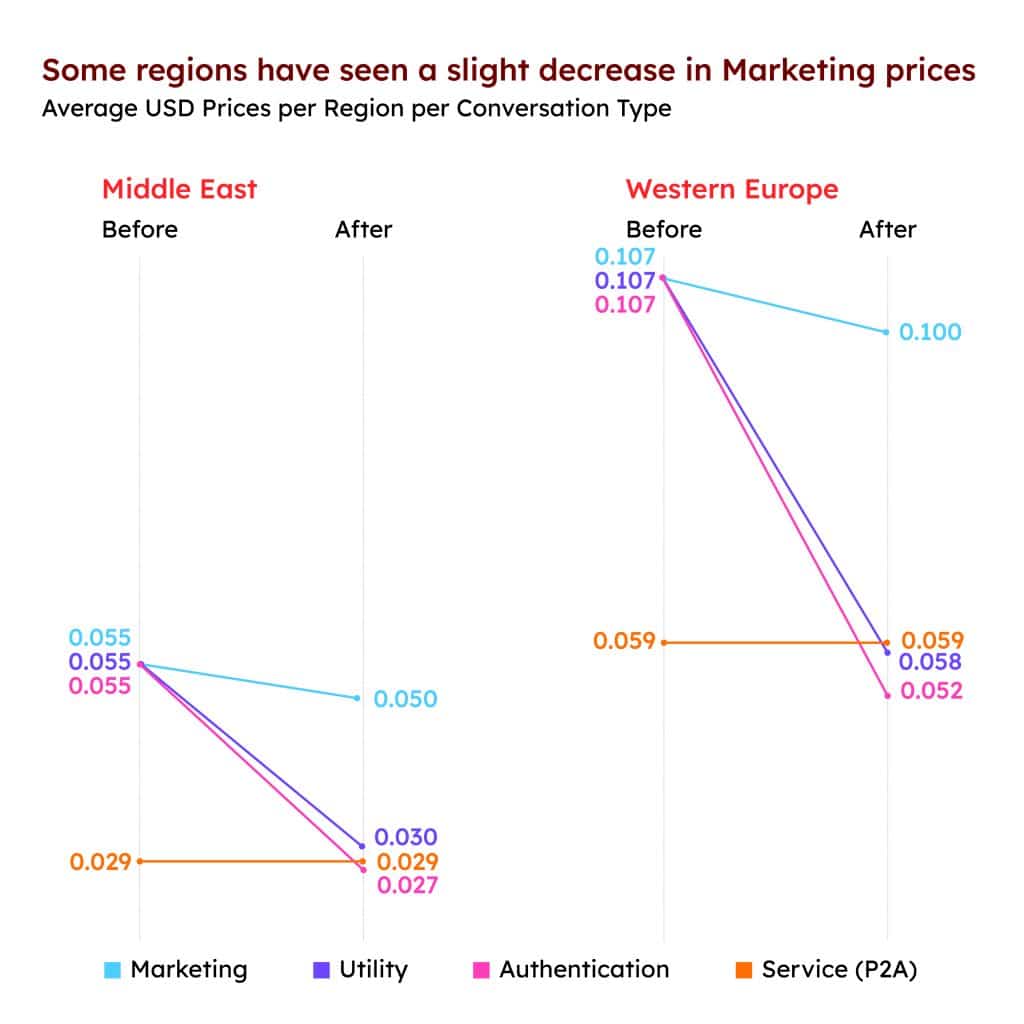

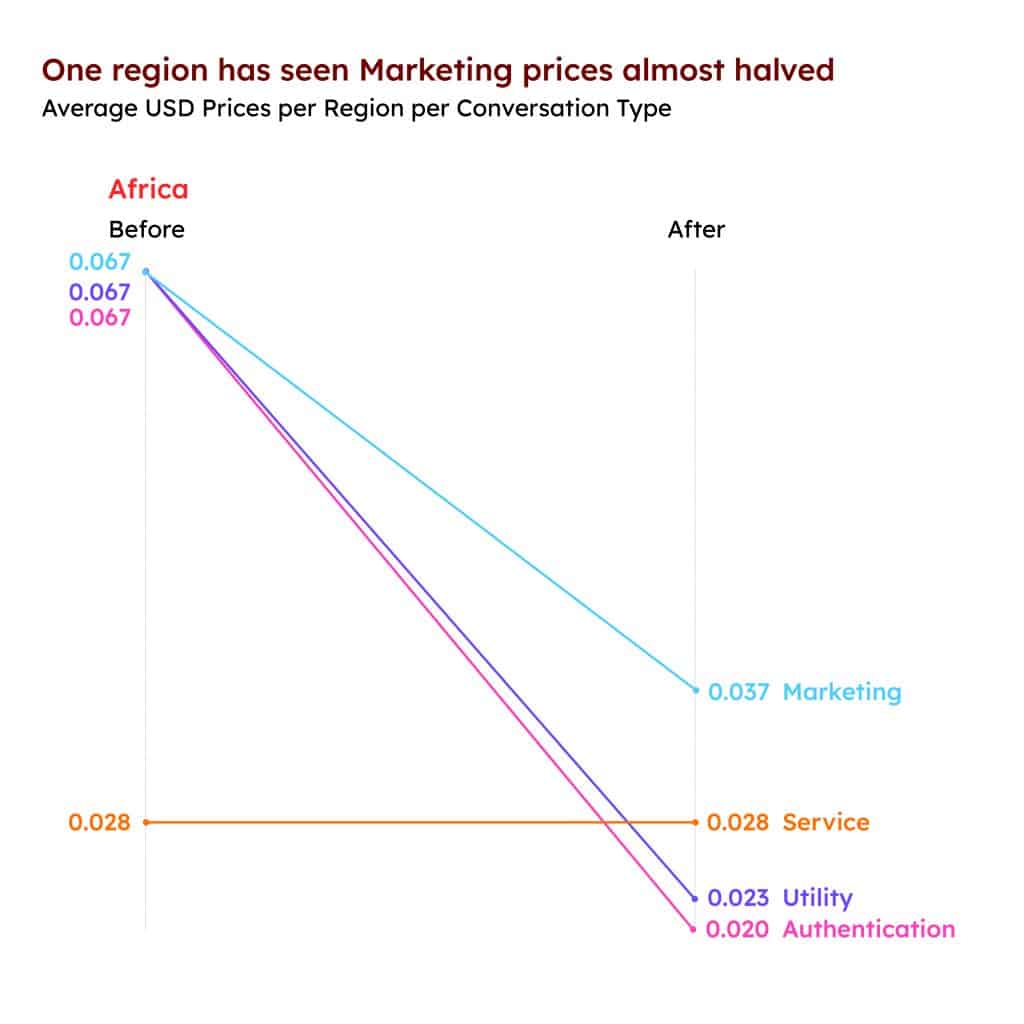

WhatsApp ramped up marketing prices in key markets. But by contrast, it made reductions of 50 to 80 percent in the outlier regions (Rest of Middle East, Western Europe and Africa). Presumably, the aim is to boost organic demand in countries that its growth team had not prioritised before.

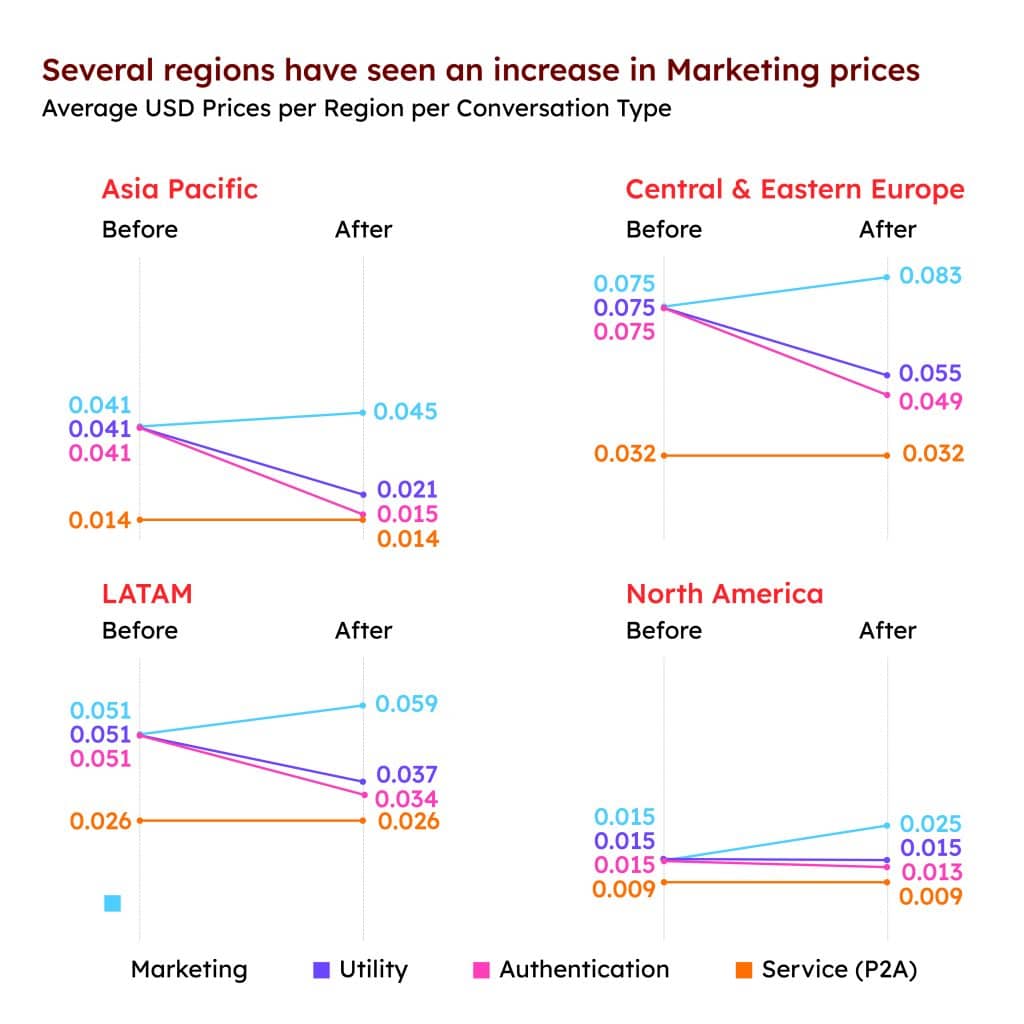

4. A closer examination of price differences at a regional level

5. Price distribution – reflecting WAB’s strengths and weaknesses?

When we see how the different regional prices line up against each other, what can we infer? Is it fair to say that WhatsApp prices its marketing traffic (at the more expensive end of the spectrum) are priced to reflect the regional trends in SMS pricing? And when the prices are comparatively lower does this suggest that WhatsApp isn’t as competitive in these regions?

There’s no doubt that WAB is now well-established as a business messaging tool. It is stronger than the other chat apps (in most regions at least), though it still lags SMS in terms of total traffic. These new price changes show that WAB remains aggressive, and still has SMS in its sights.

So, in our next article, we’ll look more closely at SMS prices today and also at WhatsApp’s penetration numbers to dig deeper into the competition between the two channels.

If you have any questions, contact the GTC team here.